The 6-Minute Rule for Paul B Insurance

Wiki Article

9 Simple Techniques For Paul B Insurance

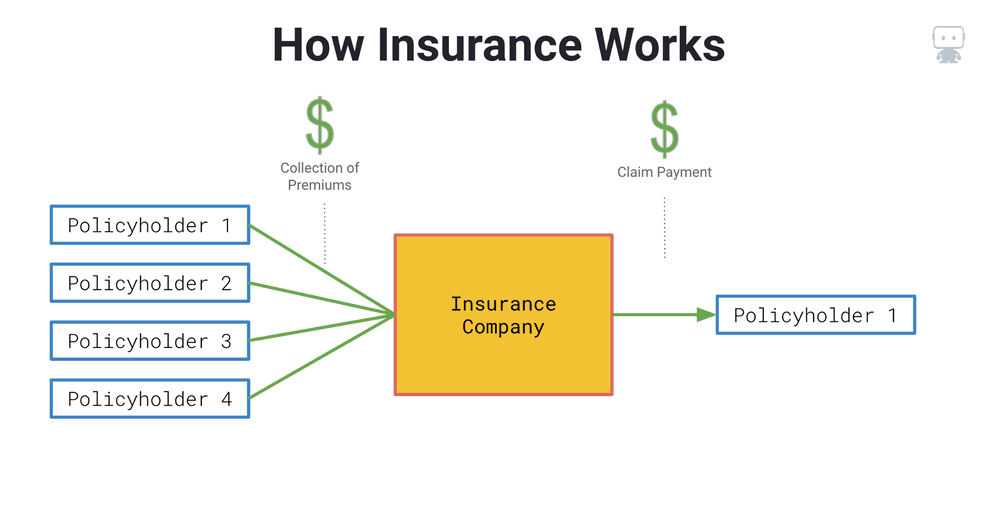

The thought is that the cash paid out in claims in time will be less than the complete costs collected. You might seem like you're throwing cash gone if you never sue, however having item of mind that you're covered on the occasion that you do experience a considerable loss, can be worth its weight in gold.

Imagine you pay $500 a year to insure your $200,000 home. You have one decade of making repayments, and you've made no insurance claims. That appears to $500 times 10 years. This indicates you've paid $5,000 for home insurance. You start to question why you are paying so a lot for nothing.

Since insurance coverage is based on spreading the threat amongst lots of people, it is the pooled cash of all people paying for it that allows the firm to build assets as well as cover insurance claims when they take place. Insurance policy is an organization. Although it would be wonderful for the firms to simply leave prices at the same degree all the time, the truth is that they have to make sufficient money to cover all the possible claims their policyholders might make.

Paul B Insurance Can Be Fun For Everyone

exactly how a lot they entered premiums, they have to modify their rates to generate income. Underwriting adjustments and rate boosts or declines are based upon results the insurer had in previous years. Relying on what company you acquire it from, you might be taking care of a restricted agent. They sell insurance from just one company.

The frontline people you deal with when you purchase your insurance policy are the representatives and also brokers who stand for the insurance policy business. They a familiar with that firm's items or offerings, but can not speak towards various other companies' plans, rates, or item offerings.

:max_bytes(150000):strip_icc()/terms_i_insurance_FINAL_-3556393b3bbf483e9bc8ad9b707641e4.jpg)

Just how much threat or loss of money can you think on your own? Do you have the cash to cover your expenses or financial debts if you have a crash? Do you have unique demands in your life that need added protection?

Paul B Insurance - Truths

The insurance you need varies based on where you go to in your life, what type of possessions you have, and also what your long-term goals and tasks are. That's why it is crucial to put in the time to discuss what you desire out of your plan with your agent.

If you get a finance to buy a cars and truck, and afterwards something happens to the vehicle, gap insurance policy will certainly repay any type of section of your financing that typical vehicle insurance policy doesn't cover. Some lending institutions need their customers to lug gap insurance.

The primary objective of life insurance coverage is to offer money for your recipients when you die. Depending on the type of plan you have, life insurance policy can cover: Natural fatalities.

Unknown Facts About Paul B Insurance

useful referenceLife insurance coverage covers the life of the insured individual. Term life insurance policy covers you for a duration of time picked at purchase, such as 10, 20 or 30 years.

Term life is popular since it uses large payments at a lower expense than irreversible life. There are some variants of normal term life insurance policy policies.

Long-term life insurance coverage plans develop cash money value as they age. The money value of entire life insurance policy policies grows at a fixed rate, while the cash worth within global policies can rise and fall.

Some Known Facts About Paul B Insurance.

If you contrast average life insurance prices, you can see the difference. For instance, $500,000 of whole life insurance coverage for a healthy and balanced 30-year-old woman expenses around $4,015 yearly, on standard. That same degree of coverage with a 20-year term life policy would certainly cost a standard of about $188 every year, according to Quotacy, a brokerage company.

Continue

However, those financial investments come with even more threat. Variable life is another irreversible life insurance coverage alternative. It seems a great deal like variable global life but is really various. It's an alternative to entire life with a fixed payout. Policyholders can utilize financial investment subaccounts to grow the money worth of the plan.

visit homepage

Below are some life insurance policy basics to help you better understand how protection functions. Costs are the settlements you make to the insurance provider. For term life plans, these cover the price of your insurance policy as well as management expenses. With a long-term policy, you'll likewise be able to pay money right into a cash-value account.

Report this wiki page